The US economy has been mostly beating expectations for two years now, thanks in large part to consumers eagerly buying just about everything that companies could sell them.

Much of this spending was powered by an estimated $2.5 trillion in excess savings that households accumulated due to federal pandemic aid and higher wages at work.

One result of this roaring consumer demand has been an increase in the price of goods and services, otherwise known as inflation.

But with inflation at a 40-year high this year, Americans are finding their monthly income isn’t going as far as it used to.

In April, the personal savings rate in the US ticked down to a 14-year low of 4.4%, according to the latest figures from the Commerce Department.

That’s half the rate it was in December, and roughly a third of where it was the year before.

Many households are already in negative savings territory, meaning they are increasingly tapping into their savings to cover purchases each month.

“This isn’t a normal recovery, and that fiscal stimulation is still in the pocketbooks of consumers,” JPMorgan CEO Jamie Dimon told investors at a conference this week. “They’re spending it, they’re spending at very strong levels.”

But, he added, the drawdown could mean that consumers have only about six to nine months of spending power left.

Dimon’s remarks echoed comments from PayPal CEO Dan Schulman last week at the World Economic Forum in Davos.

The combination of high spending and high inflation means Americans are burning through savings at a rate that could have them running out by the end of this year, he said.

Indeed, it’s already happening in the most vulnerable households. (Same in Canada…)

“We are already seeing a reduction in spending at lower-income levels for sure, and it’s moving up to middle-income right now,” Schulman said.

More than eight in ten US shoppers are planning to buy fewer things in the next three to six months, according to a recent survey from the market research firm NPD Group. The survey also found that consumers bought 6% fewer items in the first three months of 2022 than they did during the same period in 2021.

“There is a tug-of-war between the consumer’s desire to buy what they want and the need to make concessions based on the higher prices hitting their wallets,” NPD’s chief retail industry advisor Marshal Cohen said in a statement.

The slowdown in retail is already dragging on earnings from big box brands like Target and Walmart, and could have ripple effects throughout the economy.

For now, Americans are still spending (and planning to spend) a lot of money: airlines and hotels are reporting strong bookings, and the Commerce data indicate people are prioritizing services over products.

While there are promising signs of these larger economic challenges stating to improve, the next few months will be a delicate balancing act to get prices under control without causing them to crash.

“There’s storm clouds… it’s a hurricane,” Dimon said. “That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy.”

StrangeSounds.org has been banned from ad networks and is now entirely reader-supported CLICK HERE TO SUPPORT MY WORK… I will send you a small gemstone if you give more than 25$… Thanks in advance!

Nearly half of families with kids can no longer afford enough food 5 months after child tax credit ended

Without the child tax credit, Stormy Johnson has been skipping her own meals so her kids can eat.

Johnson, 45, works as a student support specialist in Preston County Schools in Kingwood, West Virginia. Before the monthly enhanced child tax credit payments lapsed in December, she received an additional $500 each month for her two children, Violet, 15, and Tristan, 14, whom she parents alone.

Without the extra money, and with increased prices due to inflation, Johnson’s budget is stretched thin.

“It’s been a struggle for sure,” said Johnson. “I’m just making sure that my kids have what they need, and I honestly think it’s taken a toll on my health physically.”

Families struggling

The child tax credit was expanded in 2021 through President Joe Biden’s American Rescue Plan.

The legislation boosted the credit to $3,000 from $2,000, with a $600 bonus for kids under the age of 6 for the 2021 tax year. Half of the credit was delivered in monthly payments, which ran from July 2021 to December 2021, in deposits of $300 for children under the age of 6 and $250 for those aged 6 to 17. Families received the second half of the credit in a lump sum when they filed taxes this year.

Now, five months after payments stopped, many families are struggling to make ends meet.

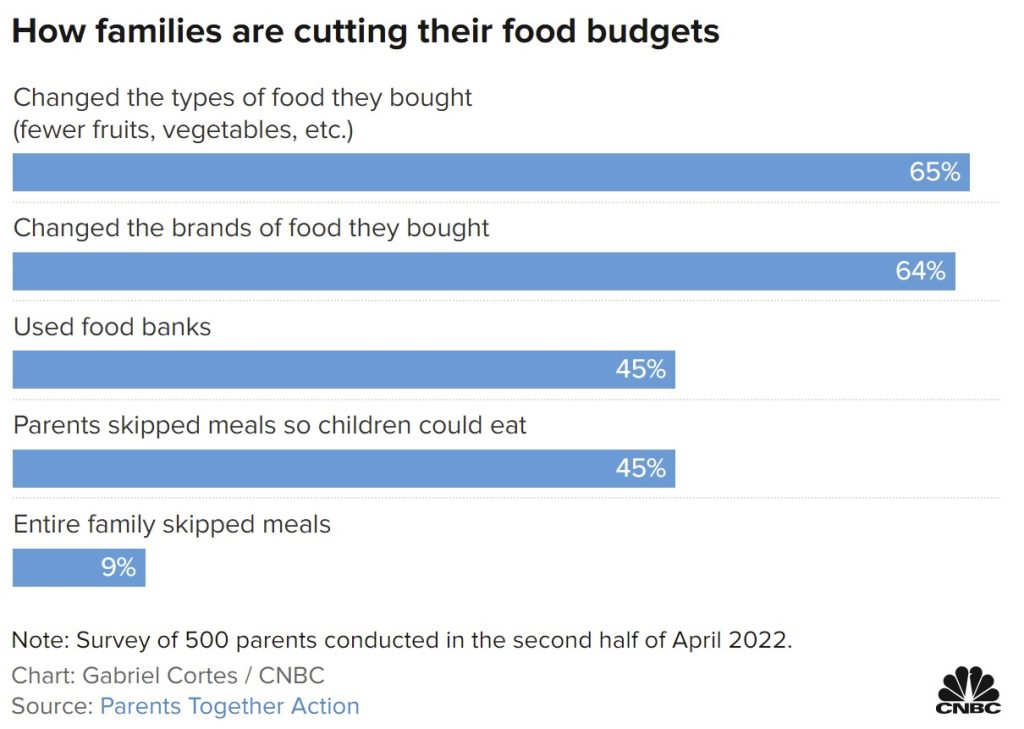

Nearly half of parents who used to get the checks now say they can’t afford enough food to feed their families, according to a May survey of 500 parents from Parents Together Action, a nonprofit. In addition to the increased costs of food, families are noticing rising prices of gasoline, child care and rent due to inflation, the survey showed.

More than 90% said that they are finding it harder to make ends meet right now, and more than 60% are struggling to satisfy their families’ basic needs. Beyond cutting back on things, most families said they’ve stopped saving for the future and have tapped into their emergency savings to stay afloat.

Others, like Johnson, have skipped meals so their kids can eat. Her family has also had to cut back on foods like chicken and fresh vegetables because they are too expensive, she said.

“I know I need to take care of myself to be able to take care of my kids,” said Johnson. “But at any given time if you give me the option to do for my kids or do for myself, especially when it comes to something like food, I’m not going to let my kids go without.”

The future of the child tax credit

It’s unclear if the child tax credit will be enhanced again anytime soon.

The monthly payments ended in December when Democrats failed to pass Biden’s $1.75 trillion economic plan, Build Back Better. Since, there’s been little movement on reinstating the credit, even as families continue to grapple with the coronavirus pandemic, high inflation and increased economic uncertainty.

“It feels totally inexcusable that Congress isn’t acting to reinstate those CTC payments, especially right now as families are struggling so much,” said Allison Johnson, campaigns director at Parents Together Action.

It’s also likely that the benefits seen from the enhanced credit will continue to erode. The expanded benefit showed positive results in improving food security for families with children, lifting kids out of poverty and even helping parents work more.

Without the benefit, it’s been estimated that 10 million children will fall back into poverty. [BI, CNBC]

StrangeSounds.org has been banned from ad networks and is now entirely reader-supported CLICK HERE TO SUPPORT MY WORK… I will send you a small gemstone if you give more than 25$… Thanks in advance!

Here some things to add to your disaster & preparedness kit:

- Protect your home and car with the best EMP, solar flares and lightning shield available…

- Drink clean water at home… Get this filter now…

- Health Ranger Store: Buy Clean Food and Products to heal the world…

- Prepare your retirement by investing in GOLD, SILVER and other PRECIOUS METALS…

- You will ALWAYS have electricity with this portable SOLAR power station…

- Qfiles is another great site for alternative news and information…

Forgive me here but most of the solutions you propose don’t solve the problem.

Simply put yall are like danged ostrichs.You fail to acknowledge the real problem.When the rotten corrupt government has destroyed businesses and peoples ability to make real choices it is a constitutional crime.Destruction of capitalism is the ultimate fault for it all.Overarching unnecessary regulations .4 gazillion agencies and registries in order to qualify for work.Zero real opportunity for hope advancement.Welfare that penalizes marriage work and true responsibility.No those who do that are forever penalized.They allow any wench who can dial a phone to stalk and harass parents.With the parents having no rights nor recourse.

Now how about everyone acknowledge the problems.

I would ask Stormy : Where your two baby daddies at? Why aren’t they supporting their kids?

You have an illegal and unauthorized adminstration ruling you. Maybe you should factor that in at WHY you are having so much trouble with your nation.

The FED and Central Banks have conspired to take down America, Globalists can’t install their Marxist dream one world government without America being crushed. The middle class is going away along with pensions, social security and any public services. Soon it will look like the feudal system of the Middle Ages with Lords and Serfs…don’t sell your guns, don’t take government promises of food at FEMA camps either, pray.

Agree, never go into detention centes of any kind. Many retirees are assuming a SS increase cost of living in 2023. Many have 401k’s paying monthly and other investments. Younger people don’t need to raise kids, both need to keep working to live. We worked, never raised any and took an early retirement. No future for the younger generations the younger the worse it will be. The golden years ended in 2019 never to return. Where are the patriots who will take this country back from the globalist control freaks? over 90% of adults don’t care about anything incl their kids or g’kids futures. (nihilism).

Won’t matter they want your guns they will take them through hook and crook.They will use false warrants false medical diagnosis even false families to further their murderous agenda.Even if you succeed in the short term they will just come back later and claim you to be a terrorist dope mule or a sex trafficker.Any lie will do.Could be from the legitimate(supposedly)government or the human termite brigade and their 7 century government.

Still won’t play they will frame you

They get to do whatever they want to anyone without recourse.They will then simply confiscate anything you own.They see themselves as God’s and the citizens as subjects serfs.They can’t wait till Marshall law is in place that way they reenact nazi germany.They are stinking festering boils on the butt of humanity.Since they have no moral values nothing is off the table.Sadly being the passive aggressive covert physcopaths that they are you will have trouble identifying them as well as holding them accountable If you are military or the offspring of one they will take great delight at your misery and torment.Its what they live for.They are the vile bastards who should have never been born.Whom if you had a time machine you’d go back in time and whip their parents ass for having them.

Meant to say for having them

Well, I have been eating as though the shtf for two years preparing myself for hard times. I also have stockpiled that same food for several years now. I won’t be shocked by food shortages. I also lost fat, and have kept myself at same weight I was 30 years ago when I worked out five days a week. So, my advice is be prepared for shtf, and practice so you won’t feel any discomfort.

Do some people still have money for cigarettes or beer? Do they have Netflix, etc? Do they spend hundreds per month on their stupid phones? How about hair color, nails, tattoos? Give up those things & then maybe I’ll have some sympathy.

I have a $9. a mo flipper for emergencies or quick calls (hate talking on phones used to work cust. svc and sales) do my own nails, hair dye instead of an $80. dye job, and still afford to buy chocolate bars.

Someone said that the economy is so bad that a truck load of Americans was caught sneaking into Mexico, CEO’s now have to play miniature golf and the oil companies had to lay off 35 Congressmen.

people have dismissed the conspiracy as a “theory” for way too long and now are beginning to feel the consequences. i feel bad for y’all, just don’t come to my neighborhood. use your strength and stand up to the tyrants or be their slaves. your choice now. i’ll die on my feet before i live on my knees.

I never tell anyone what I stash for emergencies and we are basically non social retirees (sick of small talk and trivial shallow people (most). Never open door to strangers. Those you know, tell them u are busy. People are responsible for their immediate family (minor children), not extended family, relatives, friends, or adult married children.

Yeah I finally disowned mine.

Got tired of them believing lies as well as there hatred.I didn’t give them up willingly.Spent the better part of several decades trying to hold out till I found them.Spent the last five years having them parrot the lies of an ID thief and hating me for what happened.That is if they speak at all.Keep in mind the same thong is starting to happen to them yet I’m still to blame.

Of my regrets in life having them is the strongest.

I couldn’t take hormonal birth control.If I could have they wouldn’t be here.

Due to skyrocketing inflation and the recent rise in the prices of goods and services across Iran, housing prices have also risen. As a result, this has further increased the severity of homelessness. A video circulating on social media shows a family who has lost everything and is now living on the streets behind a public toilet.

The reporter in the video said, “We have confronted a family, who has been thrown out of their home due to the lack of money. All their property is now on the street. A woman sitting in a tent with unpleasantness said: ‘At nights it is very cold here. We are freezing. We are living behind this toilet. I’m a weak and sick woman. I have kidney pain and goiter. They close this toilet in the afternoon and during the night. Where should I go? This child is suffering from anemia. This is our situation. This is our life. I would change my name if the families of these officials would live here even for two days.’

A man situated near the woman said: “Raisi has destroyed everyone.”

In regards to the rising renting prices across the country, the state-run Farhikhtegan daily wrote, “The cost of housing in Iran is twice the world average, 32 million Iranians are engaged in renting housing.”

The paper added, “According to statistics, the number of tenants in Iran has increased from 12% in 1986 to 23% by 2006, to 27% by 2011, and 38% by 2020. This means that 32 million Iranians are involved in the issue of housing rents. This number is significant from the perspective that according to statistics, in urban areas of the country, 43% of tenants’ expenses are related to housing; This figure is equivalent to 2.2 times the average household expenditure in the world.”

https://irannewsupdate.com/ same story in 173 nations?

How else will they get more cheap slaves to do their works?

Those “kids” look old enough to get theirselves a job and help out.

Enlighten us, what are their ages?

Any kid 12 and over needs to earn money in these tight situations stocking shelves, cleaning (janitorial) factor work,. etc. parents can home school. Orphanages may be best for food and shelter since parents can’t spt them.

It’s illegal for a twelve year old to work legally unless they are in a family business or are in the entertainment industry least ways here in us.Yeah let’s bring back orphanages it isn’t like 1929 enigh for everyone yet.