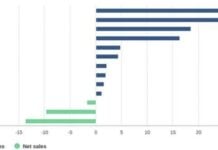

The Swiss National Bank (SNBN.S) lost 142.2 billion Swiss francs ($142.60 billion) in the first nine months of 2022, it said on Monday, as rising interest rates and the stronger Swiss franc slashed the value of the central bank’s foreign investments.

The loss – the largest in the SNB’s 115-year history – was slightly more than the annual economic output of Morocco ($132 billion), but the central bank does not face bankruptcy thanks to its ability to create money.

The SNB made a loss of 141 billion francs from its foreign-currency positions as the bonds and stocks bought during its campaign to stem the appreciation of the safe-haven franc slid in value.

The figure included exchange rate-related losses of 24.4 billion as the stronger franc further reduced the value of its holdings, which include stakes in coffee retailer Starbucks (SBUX.O) and Google owner Alphabet (GOOGL.O).

Gold holdings lost 1.1 billion francs in value.

“These losses may sound like a lot, but the SNB is not a normal company,” said UBS economist Alessandro Bee.

“The problem is the stagflationary environment where equities lose, bonds lose, gold loses and the Swiss franc becomes stronger. Normally bonds and gold gain when equities lose. But that’s not happened in 2022.”

“Normal bankruptcy rules” do not apply, he added, noting that the SNB, which made a 41.4 billion franc profit a year earlier, would always be liquid as long as there is demand for Swiss francs.

The loss could, however, mean that the central bank halts payouts to the Swiss federal and cantonal governments next year.

Prepare now! Protect your home and cars againts EMP, solar flare and lightnings…

Canton Zurich received 716 million francs as its share of the 6 billion francs distributed by the SNB this year, but said it knew there was no guarantee of the central bank cash.

Nearby canton Zug said omitting an SNB payout would be no problem.

“The SNB is not a normal bank, it’s a central bank which has other tasks such as price stability and protecting the Swiss economy,” Heinz Taennler, Zug’s finance director, told Reuters.

“We are not dependent on the payment from the SNB, but I can’t say if that’s the case for other cantons.2

Continued massive losses could wipe out the SNB’s equity, which stood at 204 billion francs at the end of 2021.

The SNB, which has recently started hiking interest rates to combat inflation, declined to comment on the loss or what it would mean for a payout or its more restrictive monetary policy.

Still, Vice Chairman Martin Schlegel indicated a slide into negative equity would not alter the central bank’s approach. He also expected a positive long-term return on the bank’s investments.

Prepare now! Stock up on Iodine tablets for the next nuclear disaster…

“We can pursue our tasks and fulfill our mandate even with negative equity capital,” he said in an interview published on Friday.

“Nevertheless, it is important that we have enough equity. It helps the credibility of a central bank if it is well capitalized.”

In other words, the Swiss guy is now going to work to own nothing… We will have to pay for the SNB… Bad for my country and my economy… [Reuters]

Well with stagflation, I’m doing what I did in the 70’s, that is, buying some extra silver. Got 20 rounds this week. Never liked paper. I’ll stick to my guns. I remember unloading silver scrap coin (G-VG) at $47 an ounce, and rolling it into MS 65 or better coins.

Bought more rice too. I’m at over 500 lbs. in stock now. Prepare yourselves. It will get much worse before it gets better.

Word of the day is P A R L A Y !

Yes, exactly, prepare for the worst. Rice, pasta some doses and a lot of water or a good filter…

“… but the central bank does not face bankruptcy thanks to its ability to create money.”

This fiat money is all the worse due to fractional Reserve Banking. This is massive fraud. The worlds biggest ponzi scheme. Nothing more, nothing less.

I honestly don’t know if the human race has the ability to government itself. We keep getting saturated in crime, fraud and corruption.

Exactly… As long as the CHF stays strong there will never be a problem, they will print some more, over and over…

The human race needs to accept we are governed by psychopaths and perverts and revoke the consent to be governed.

Govern= Latin:

governe(to control) + mentis (the mind)