The price of gold is at record highs, but it’s being bought in record quantity, and China is dumping record amounts of US treasuries. What do they know we are not allowed to know?

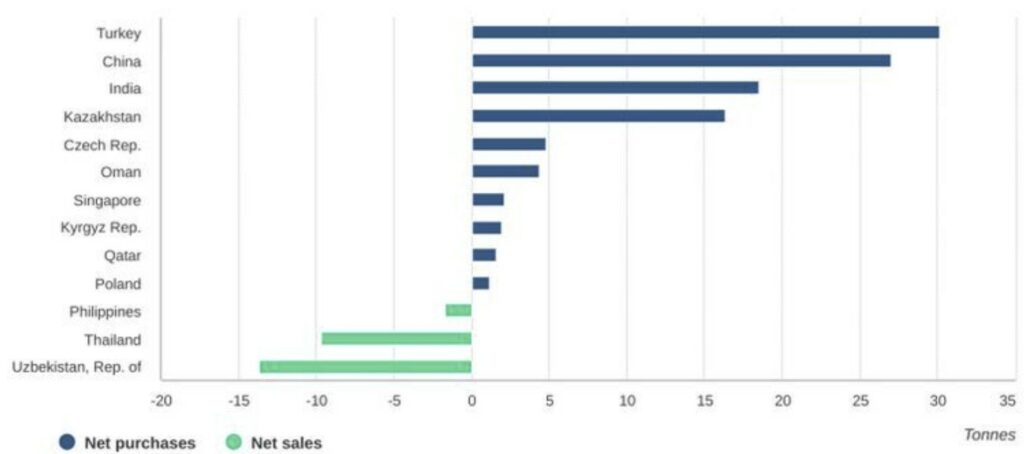

Central banks are in the midst of a gold buying spree, according to new numbers from the World Gold Council (WGC).

The organization says central banks added $24 billion of gold, weighing 290 tonnes, to their coffers in the first quarter of this year.

That’s the strongest level of net demand for any quarter on record, using data that dates back to the year 2000.

The WGC says China, Turkey, India and Kazakhstan are driving much of the demand for the precious metal.

“Many have attributed central banks’ ongoing voracious appetite for gold as a key driver of its recent performance in the face of seemingly challenging conditions: namely, higher yields and US dollar strength. And despite the high bar set in the last two years, the voracious buying has continued into 2024 in the face of the renewed gold price rally…

Not only is the long-standing trend in central bank gold buying firmly intact, it also continues to be dominated by banks from emerging markets. Ten central banks reported increased gold reserves (of a tonne or more) during Q1, all of whom have been active over recent quarters.

The WGC says the previous quarterly record for net demand was set in Q4 of last year, weighing in at 286 tonnes.

The group says more data is needed to determine whether gold’s recent rise in price will have an impact on central bank purchases moving forward.

“While the recent price rally may have impacted trade execution, for those central banks that manage their gold reserves more actively, we do not expect it will derail any strategic gold accumulation plans they may have.”

Gold has moved from around $2,000 at the start of this year to $2,347 at time of publishing.

The price of gold is at record highs, but it’s being bought in record quantity, and China is dumping record amounts of US treasuries. Meanwhile the West has resorted to stealing assets from Russia (and Afghanistan), is concocting ever more sanctions against the multipolar alliance, and is intensifying its warmongering…

Hey friends, it’s time to wake up!

If a few more people choose to support my work, I could expose more lies, root out more corruption, and call out more hypocrites. So, if you can afford it, please support my endeavor by either using PAYPAL or the DonorBox below (PAYPAL & Credit Cards / Debit Cards accepted)…

If you are a crypto fanatic, I do now accept crypto donations:

BTC: 1AjhUJM6cy8yr2UrT67iGYWLQNmhr3cHef (Network: Bitcoin) USDT: 0x490fe5d79d044a11c66c013e5b71305af0a76c1b (Network: Etherum ERC20)

You should join my newsletter to get a daily compilation of different breaking news, pictures and videos… YOU WILL LOVE IT!

Thank you,

Manuel

Then maybe you can explain why three weeks ago or so the price when way up only to trounced by the gold banks that very next week. Two seeks went by as the price struggled to gain what it lost, which it did to almost the same height, only to dump on the price of precious metals this week.

If the GD World Gold Banks are buying many tons of gold the price should continue to increase, but it is not, which tells me that the prices are being manipulated by the banks for, I am assuming” the purpose of supporting our failing dollar.

Who cab we contact about this kind of manipulation of precious metals? We should make it a law that those who set the price cannot also take advantage of the lower prices they propose twice a day. We must demand the corralling of that Conflict of Interest and prosecution of those who try and outwit the law of Supply & Demand !!!